HR Business Management SR Corporation (HRBM) is an expert on payroll calculations and HR management consulting for foreign companies doing business in Japan.

HR Business Management SR Corporation

ST Bldg.

1-2-4 Shiba-Koen, Minato-ku

Tokyo, Japan 105-0011

Payroll in Japan

Procedures required to start payroll calculation

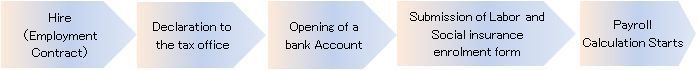

Before starting payroll calculation, the following administrative procedures are required

in Japan.

Regarding the enrollment to Social insurance and Labor Insurance in Japan, there are 3

patterns according to the Japanese office's form of organization and the position of the

employee; on a compulsory, or voluntary basis, and the ungrantable cases.

Furthermore, in order to calculate payroll in Japan, opening an account in a Japanese bank is necessitated from the aspect of the payment of social insurance premiums, corporate and

individual income taxes.

Pay Day and the Computation Period

The following rules are general in Japan;

Computation Period: 1 month - from the first to the last day of the month

Pay Day: 25th of every month (For the period of the 26th to the last day of the month,

it will be paid in advance / if the payday is a non-working day, it will be paid on the business

day just before.)

The Method of Payment: Bank Transfer

Salary Revision: Once a year

☆ If you plan to pay bonus, it must be indicated on the employment agreement.

Notification of Incorporation to the Tax Office

Income tax withheld at source from employees through payroll calculation must be paid to

the tax office which exercises jurisdiction over the place of business which paid the salaries,

no later than the 10th day of the month following that in which the income was paid.

(If it falls on a Saturday, Sunday, or a national holiday, by first business day after the day.)

On the statement of payment, you need to put the reference number designated by the tax

office. In order to obtain the reference number, you need to file 'The notification of the

opening of a payroll office' to the jurisdictional tax office within a month of the opening of a

payroll office.

The Japanese Social Insurance System

There are two prominent groups of Japanese social insurance system according to the type; 1) Social insurance which is consisted of Health Insurance, Nursing Care Insurance, and

Welfare Pension Insurance, and

2) Employment Insurance and Worker's Compensation Insurance.

See more information.

Business Office Under the Coverage of Social Insurance

Health Insurance and Welfare Pension Insurance are applied by establishments. Those are

called eligible places of business, and there are 2 categories. Those which are compulsorily

covered by law, and voluntarily covered.

Corporations (including Japanese branches of foreign corporations )which employ more

than one employee are obliged to enroll as establishments covered compulsorily by Health

Insurance and Welfare Pension. By 'Employee' in this context, officers in Commercial Code

are included.

As for the representative offices of foreign corporations, they are covered compulsorily if

there are more or equal to 5 employees. However, if there are less, they don't fall into the

category. Representative offices of foreign corporations in Japan which conduct market

research in Japan or liaise with the Head Office or main overseas office with less than

5 employees can be covered voluntarily, with the approval of half of the employees

(excluding the representative in Japan,) and approval from Director-General of a Regional

Social Insurance Bureau...etc. to enroll social insurance.

Business Office Under the Coverage of Labor Insurance

Regardless of the form of organization, (whether it is a corporation, a branch office, or a

representative office, all establishments are under the coverage of Labor Insurance as long

as it has an employee or more and conducts business.

Bank Account

1) The necessity of a Japanese Bank Account

We see cases where foreign-affiliated companies try to open bank accounts in Japanese

branches of foreign banks which the Head Office or main overseas office regularly deal with.

However, there are many disadvantages with bank accounts opened in such Japanese

branches of foreign banks. First of all, you cannot pay the social insurance premium,

corporate tax, and income tax. Furthermore, there are very limited number of branches in

Japan.Therefore, at least one account with a Japanese bank is required to realize payroll

calculation in Japan.

2) Internet Banking Services

Most of the Japanese banks provide internet banking services, and many Japanese companies utilize the services for bank transaction. By taking advantage of this service, you don't need

to go to banks and make the bank transfer from your office. However, every bank provides

the service only in Japanese, and in general, the use from outside the country is not

guaranteed. Furthermore, account statements which will be printed out will also be in

Japanese only. Therefore, you can make payment of the cost of public utilities such as

various taxes from overseas by using internet banking services, but due to language barrier of computers, the operations will be limited to those from within Japan.

Where to contact

Payroll / HR Services in Japan

HR Business Management SR

Corporation

ST Bldg. 1-2-4 Shiba-Koen,

Minato-ku Tokyo, Japan 105-0011

"Hi, I am Teizo Hirasawa,

representative of HRBM.

If you have any queries,

please do not hesitate to

contact us."